Analytics as a service Market Summary

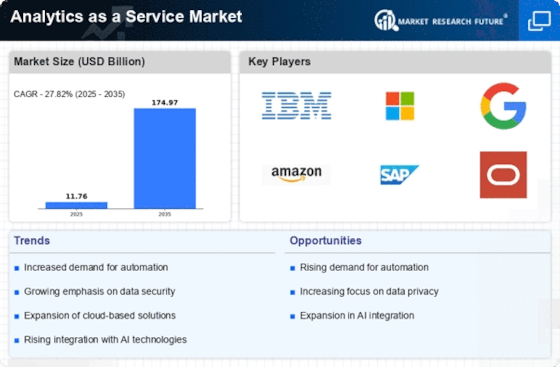

As per Market Research Future analysis, the Analytics as a Service Market Size was estimated at 11.76 USD Billion in 2024. The Analytics as a Service industry is projected to grow from 15.03 USD Billion in 2025 to 174.97 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 27.82% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Analytics as a Service Market is experiencing robust growth driven by technological advancements and increasing demand for data insights.

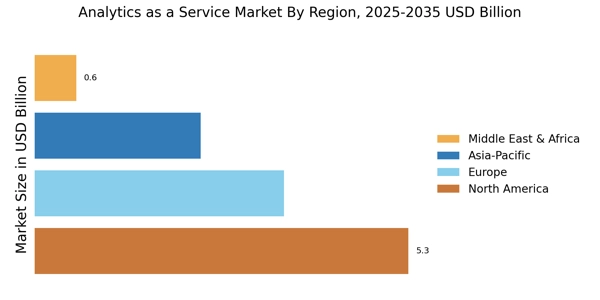

- North America remains the largest market for Analytics as a Service, driven by high cloud adoption rates.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid digital transformation initiatives.

- Solutions represent the largest segment, while Services are witnessing the fastest growth due to evolving customer needs.

- Key market drivers include the rising demand for data-driven decision making and an increased focus on real-time analytics.

Market Size & Forecast

| 2024 Market Size | 11.76 (USD Billion) |

| 2035 Market Size | 174.97 (USD Billion) |

| CAGR (2025 - 2035) | 27.82% |

Major Players

IBM (US), Microsoft (US), Google (US), Amazon (US), SAP (DE), Oracle (US), Salesforce (US), SAS (US), Tableau (US), Qlik (US)